Picking the Right Medicare Supplement for Your Insurance Plan

When it comes to ensuring detailed health care coverage, selecting the suitable Medicare supplement strategy is a crucial choice that needs mindful consideration. With various options available, each offering different advantages and costs, navigating this process can be complex. Recognizing your specific health care needs, contrasting plan functions, and evaluating the connected expenditures are all essential action in making an informed option. By putting in the time to study and assess these factors, you can confidently safeguard a Medicare supplement strategy that finest matches your insurance plan and provides the insurance coverage you need.

Recognizing Medicare Supplement Program

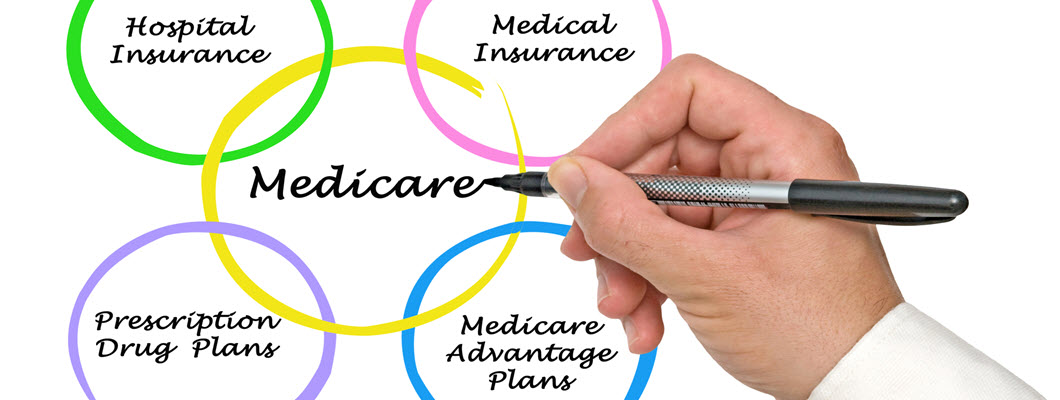

When navigating the intricacies of Medicare, people usually discover themselves taking into consideration numerous Medicare Supplement prepares to complement their existing coverage. Medicare Supplement prepares, additionally called Medigap policies, are supplied by exclusive insurance provider to aid cover the gaps in Initial Medicare, including copayments, coinsurance, and deductibles. These strategies are standard and labeled with letters, such as Plan A, Fallback, as much as Strategy N, each offering various levels of coverage.

It is necessary for people to comprehend that Medicare Supplement prepares work together with Original Medicare and can not be used as standalone insurance coverage. These strategies usually do not include prescription medicine coverage; individuals may require to enlist in a separate Medicare Component D plan for prescription medications.

When examining Medicare Supplement prepares, it is crucial to contrast the benefits offered by each strategy, in addition to the associated expenses. Costs, coverage alternatives, and supplier networks can differ between insurance provider, so individuals should thoroughly assess and contrast their choices to pick the plan that finest meets their health care requirements and budget.

Analyzing Your Health Care Needs

Comparing Strategy Options

Upon examining your medical care requires, the following step is to contrast the different Medicare Supplement plan options readily available to identify one of the most suitable protection for your clinical expenses (Medicare Supplement plans near me). When comparing plan options, it is vital to think about variables such as insurance coverage benefits, prices, and supplier networks

Firstly, check out the coverage advantages used by each strategy. Different Medicare Supplement plans offer varying levels of coverage for solutions like health center stays, proficient nursing treatment, and medical professional gos to. Assess which advantages are most crucial to you based upon your health care needs.

Second of all, contrast the expenses related to each strategy. This consists of monthly premiums, deductibles, copayments, and coinsurance. Medicare Supplement plans near me. Comprehending the overall price of each strategy will certainly aid you make an educated decision based on your budget and monetary situation

Last but not least, think about the company networks connected with the plans. Some Medicare Supplement strategies might limit you to a network of doctor, while others enable you to see any doctor who approves Medicare people. Ensure that your page recommended doctor are in-network to stay clear of unanticipated out-of-pocket expenses.

Evaluating Costs and Protection

To make an informed choice on choosing the most appropriate Medicare Supplement strategy, it is critical to thoroughly evaluate both the expenses connected with each strategy and the insurance coverage advantages they offer. On the various other hand, higher premium plans may provide even more extensive insurance coverage with lower out-of-pocket expenses.

In enhancement to expenses, carefully examine the insurance coverage benefits offered by each Medicare Supplement from this source strategy. By assessing both prices and insurance coverage, you can choose a Medicare Supplement strategy that satisfies your monetary and healthcare needs properly.

Register in a Medicare Supplement Plan

Enrollment in a Medicare Supplement plan calls for a complete understanding of eligibility standards and registration periods. To be eligible for a Medicare Supplement strategy, people must be enrolled in Medicare Part A and Component B. Commonly, the very best time to register in a Medicare Supplement plan is throughout the open enrollment period, which starts when a private turns 65 or older and is enlisted in Medicare Component B. Throughout this period, insurer are usually not enabled to deny protection or fee greater costs based on pre-existing problems. Missing this window may lead to clinical underwriting requirements or greater premiums. There are other enrollment durations like Guaranteed Concern Civil liberties, which offer added chances to enlist without medical underwriting. It is crucial to Full Report be familiar with these registration durations and qualification standards to make an educated choice when choosing a Medicare Supplement plan that best suits individual health care needs and monetary scenarios.

Final Thought

Finally, selecting the proper Medicare Supplement strategy calls for a complete understanding of your medical care requires, contrasting various plan choices, and examining prices and coverage. It is essential to enlist in a strategy that aligns with your specific needs to ensure extensive wellness insurance policy coverage. By carefully examining your alternatives and selecting the ideal plan, you can safeguard the required assistance for your clinical costs and health care requirements.